In episode 3 we’re talking about spending plans. There are a number of ways to track your spending, we’ve got a list of apps below. Since getting started can be a chore, we recommend you either spend one month tracking all you spending with pen and paper or pick one category like entertainment and track in that area.

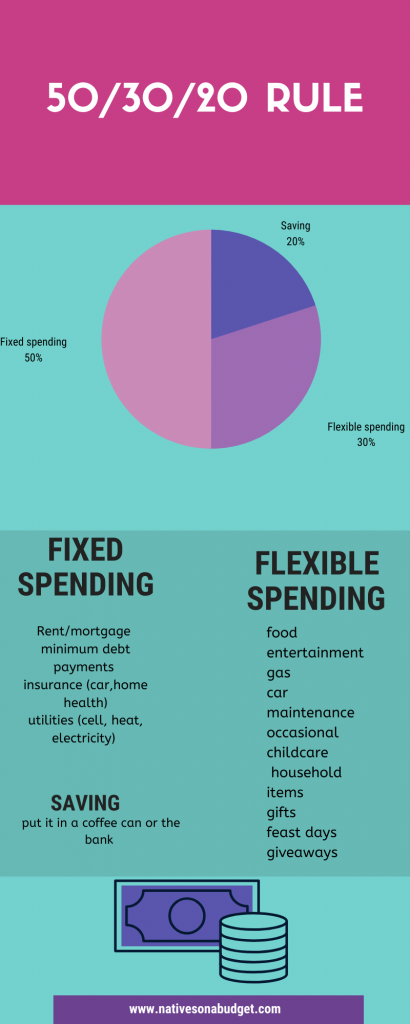

Shawn recommends the 50/30/20 rule. 50 percent of your spending is on fixed expenses, 30 percent is on flexible and 20 percent goes to saving. He also insisted that fanny packs are back in, Monica disagrees.

We also talk about the dumbest things we’ve spent our money on, and if coupons are worth the time. Airline tickets for internet friends and extra lives in Candy Crush were at the top of the list.

Sign up for our newsletter! You’ll get an email every once in a while that has good stuff! The only thing we’re selling is financial literacy!

Spending Plan Apps

EveryDollar is a zero based budgeting app, meaning you track your earnings and all spending and at the end of the month the balance should be zero. The app is free, but you can’t link your bank accounts in the free version. For EveryDollar Plus it costs about $11/month (129.99 a year paid up front). It also comes with access to Dave Ramsey’s Financial Peace University. You can not link credit cards in EveryDollar Plus. Ramsey is vehemently against borrowing money including using credit cards. The app is really easy to use.

You Need a Budget is also zero based budgeting. It costs 83.99 a year after the 34 day free trial or 11.99 a month, cancel anytime. Also students get a free year.

Mint.com

Mint is probably the most widely used tracking program. It is totally free. You can link all your bank accounts. The company has some ads and they also advertise financial products like loans. Some do report more glitches, but for the most part its a pretty easy app to use.

Wally

The neat thing about Wally is you can track by taking pictures of your receipts. It only works on phones, no desktop application. And it is free.

Check back soon, more to come!

Heya i am for the first time here. I found

this board and I in finding It truly helpful & it helped me out a lot.

I’m hoping to provide one thing again and help others such as you

helped me.